Moroccan market

Strong economic fundamentals to support the development of the Fintech sector

93%

Internet connection penetration

$40B

Potential mobile transactions

37M

2.7M with more than $5K/y* income

56%

Unbanked population

$11B

Incoming remittances*

300K

PoS network

13K

Graduates in ICT sector

Note: all statistics are for the year 2021, except 2022 when mentioned by asterisk (*)

Sources: Bank Al Maghrib (central bank); ANRT (National Telecom Agency); World Bank; Economist Intelligence Unit (CGIDD); Office des Changes (Foreign Exchange Office); CMI (interbank payment centre)

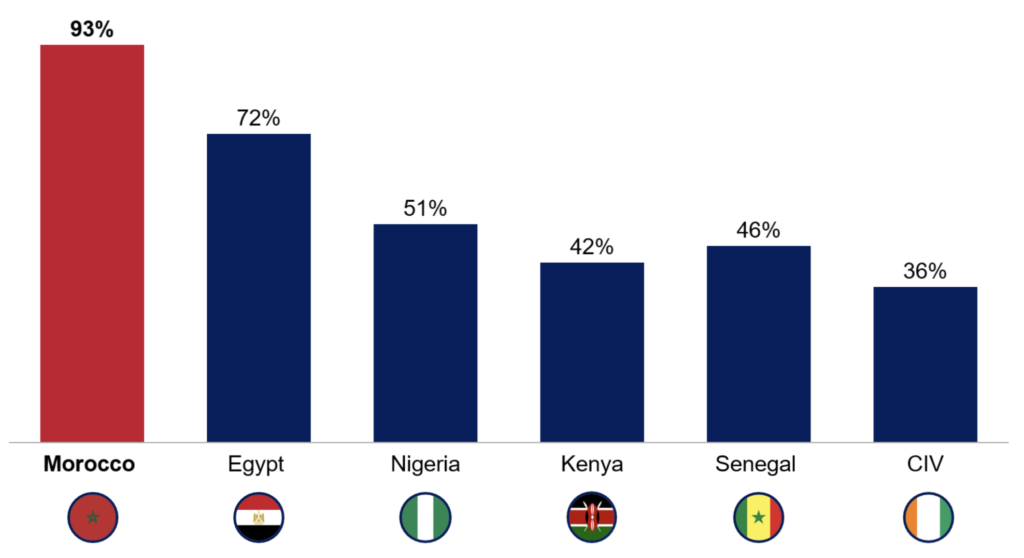

Internet penetration rate (2021)

Source: World Bank, ANRT (Moroccan National Telecom Agency)

High internet connection penetration

The infrastructure is in place to support the emergence of new digital products and trends

Morocco has one of the highest Internet penetration rate in Africa with a full cell phone penetration, with 32M internet users at the start of 2022

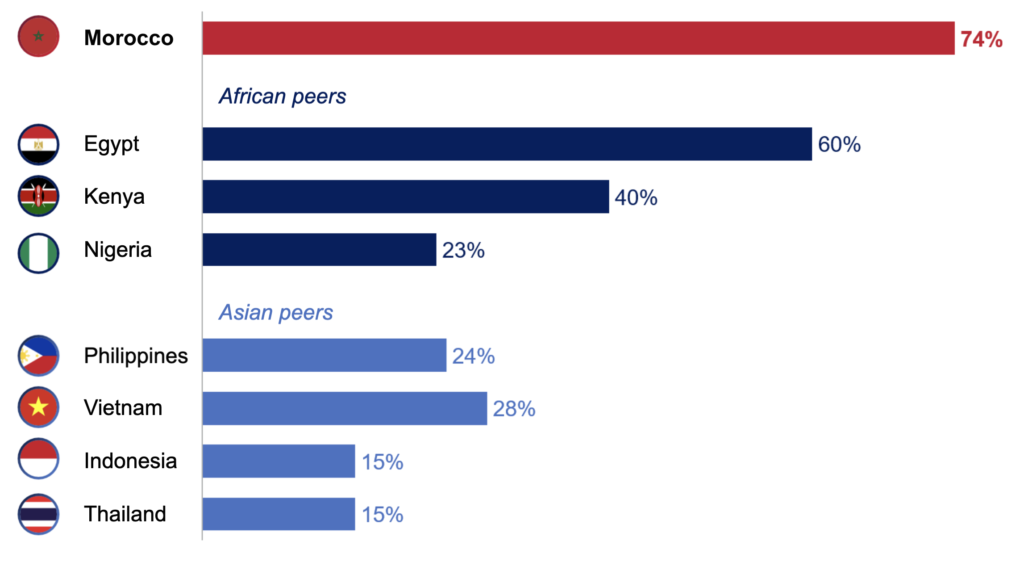

Growing digital economy

Consumers' habits are starting to change, but this change is relatively nascent

Morocco remains a cash economy with card transactions growing steadily but mobile money potential remains predominantly untapped

Share of cash-based payments (2022)

Source: MerchantMachine

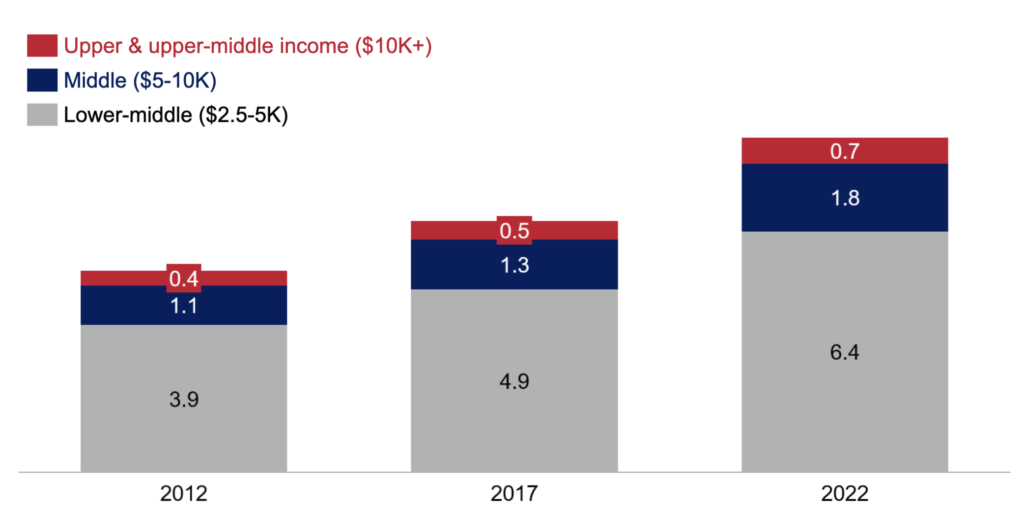

Individuals in the formal sector (#M) by income group (PPP)

Source: Economist Intelligence Unit (CGIDD)

Growing upper & middle class

Morocco has an expanding affluent segment who are looking for opportunities and mechanisms to make investments

Lack of investment platforms pushes Moroccans to invest in risky & forbidden assets: cryptocurrency trading reached $6M in Morocco in 2021, 4th in Africa behind Nigeria, South Africa, and Kenya

Financial inclusion challenges

Morocco has a lot of room for improvement, with lower level of financial inclusion than Kenya or Senegal, and authorities recognize the role Fintech can have in improving financial inclusion, with government initiatives support the development of mobile money and the banking sector

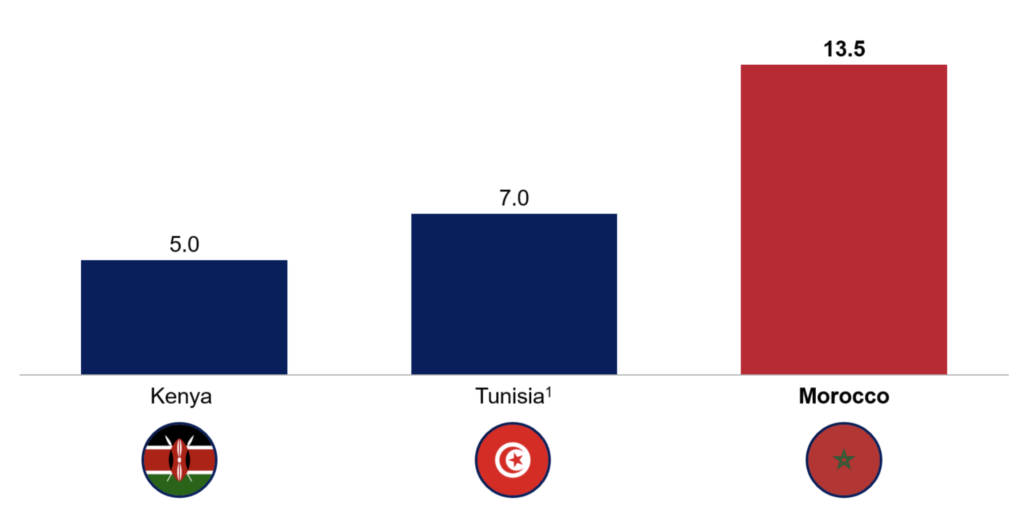

Account ownership at a financial institution or with a mobile-money-service provider (2021)

Source: World Bank, Bank Al Maghrib (Moroccan central bank)

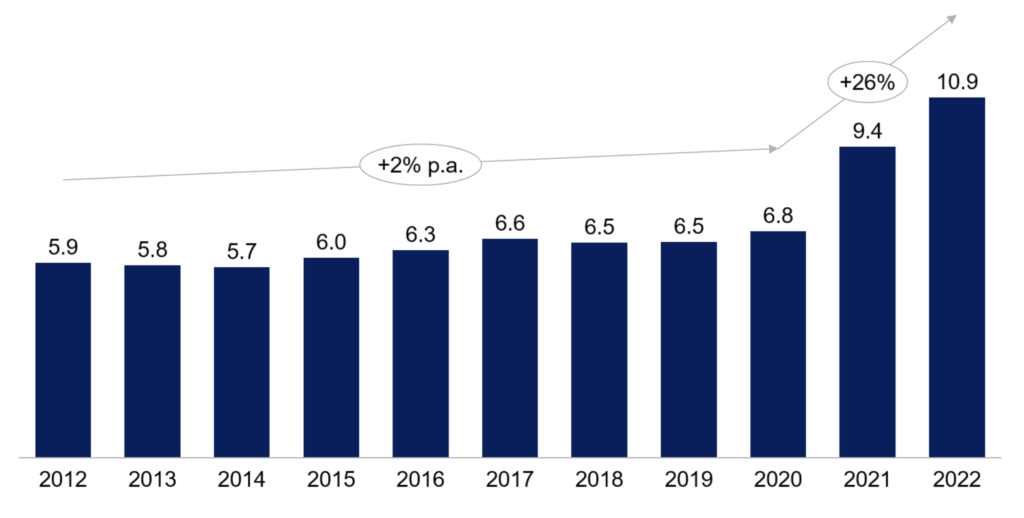

Incoming remittances flow ($B)

Source: Office des Changes (Foreign Exchange Office)

Significant remittance flows

The large Moroccan diaspora sends significant sums into Morocco: migrant remittances to Morocco have steadily increased over the past 5 years

But these flows remain confined to traditional and expensive channels: digital players only capture less than 5% market share

Large retail network to leverage

Mobile money potential could be addressed by leveraging a large SME network as mobile agents

Especially, in addition to having total absolute numbers of PoS (300K PoS), grocery stores have reach across urban and rural communes of Morocco, high traffic from all segments of the population, notably inclusive of women customers and are central to rural economic ecosystems

Typical local grocery store in Casablanca. 'Hanouts' have reach across urban and rural communes of Morocco, with high traffic from all segments of the population, notably inclusive of women customers; they are central to rural economic ecosystems (i.e. often only brick and mortar merchant, hub for social activity, relay for mail)

ICT graduates (2021)

1. 2019 figure

Source: Ministry of Higher Education, UNESCO ICHEI, Huawei (Digital Talent Review Morocco)

Significant talent pool

Morocco is a talent hub with more than 13K tech graduates every year

Morocco is not unlocking its full potential yet, with only 3% of ICT talents coming from continuous training to update their skills